Your Biz at BBuz

Mandan, ND 58554

ph: 701 220-2297

suzybbuz

- Home

- Mandan Visitor's Fund

- Mandan Cemetery Changes Proposed May 16, 2015

- Governor adds a Task Force

- Property Tax Tidbits 2012

- Bait n Switch Walmart

- Enrollment numbers just in 1/11/2012

- REAL estate

- Heaven

- DC is local?

- BIG Give Away

- A BAD Habit

- In the News

- Videos

- Foreclosure Forecast

- Where Do I Vote?

- Pew on Few

- STOP scaring grandma!!

- Visitor

- Fong Answers

- Projected Revenue August 2011

- North Dakota Surplus

- $100 Giveaway

- Fire

- Remember When

- M2 on Personal Property

- Who owns the most property in our state?

- Mary Says

- Ladd Says

- Put on your Big Boy/Big Girl Pants

- Economist M2

- Huh?

- Fargo 44%

- What percent of my city's budget is property tax?

- "FREE" Lunches in Mandan

- Lucky or Unlucky the give away

- Measure 2 Revolutionary

- Property Tax Limitations on Local Government

- Helpful Links

- Offended by Fargo Forum Editorial

- Mandan Mayor said he was sorry and

- Options-adding on--using the old junior high GPA--new school

- What I wanted to say publicly at the city commission meeting but wasn't allowed

- Convince taxpayers

- Mandan's Debt

- Spreadin Sunshine

- About Suzy

- Come on Down

- Snow angels

- SEE IT Multi-purpose Facility

- Contact Info

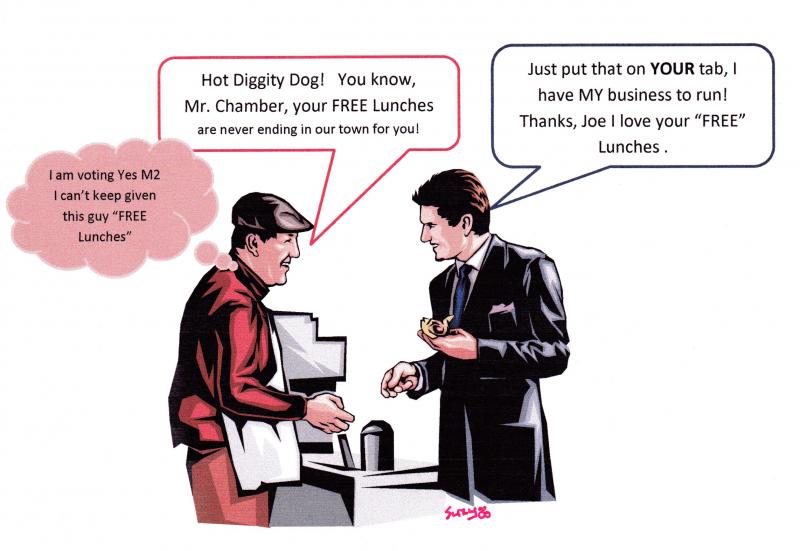

"FREE" Lunches in Mandan

Hot dogs get your Hot dogs!

"Ketchup" extra $600,000

Using a home as the representation of the value of the tax not being collected, a $100,000 home in Mandan pays abt $2000 in taxes.

References from 2009 Tax Exemption Report Generated from Richard Barta’s Mandan city hall office and some of the businesses are listed below :

Page One

Mike & Geris Hopfauf (home builders) $10,806 per year for 4 years (abt 5 homes per year)

Mandan Security Bank $31,015 per year for 4 years (abt 15 homes per year)

McFall Publishing $4,342 per year for 4 years ,(abt 2 homes per year for the taxes, the property gift abt $215,000 it would take over a 100 homes to make up what was lost in property) the building was purchased by this company for $1 and it is sitting empty and up for sale

Bill Barth Ford $17,000 per year for 4 years (abt 7 homes per year)

Page Two

MDI Limited an out of state partnership which does not pay their fair share of street improvements;

14 year tax exemption $54,142 in taxes almost 1 mil (26 homes)

WW Ranch two exemptions on this page and they were just granted under their company Jessara Mike Wachter requested 3 apartment buildings be exempt despite protests from other apartment owners abt $15,000 per year (7 homes for this and the exemption the other night was over $100,000 each year for 2 years; 50 homes)

SSCT Investments, this is our Seven Seas Best Western Hotel, the owner is the Bisman Chamber Chairman Mr. Gangl, and they received an exemption of $39,164 per year for 4 year(abt 20 homes)

Helbling Land Company, our current Mayor two exemptions totaling over $11,000 in taxes he is not required to pay (abt 5 homes)

Lakewood Village was a 10 year tax exempt and just recently they were given a full tax exemption as a nonprofit; first they came in as a business and now no longer will be paying taxes over $28,000 dollars in tax revenue lost per year (abt 14 homes will need to be built every year to support this housing project)

Goldammer 2 exemptions abt $5000 in exemptions just had property come back to the county for non-payment of taxes it was listed as Mitzel/Goldammer on the deliquent sale

Page 3

T & N Properties an out of state company granted $19,700 in taxes per year for 4 years, to build next door to a mom & pop business selling similiar items, mom & pop no tax exemption yet they are still competing, (abt 5 homes)

Mitzel builders our Mandan city "preferred" developer in 2009 has 3 properties not requiring $20,000 in taxes (abt 10 homes) he just had several properties come up on the counties delinquent sale, for non-payment of taxes. The land recently purchased by our school district was up for non-payment of taxes, the taxpayers paid themselves for property which may have been purchased for $1 by the developer and it just went to the taxes which should have been paid in the first place. Looking at his property now, of over 125 listed on the Morton County tax books, it looks like 99 might be coming back to the taxpayer. How does this affect a property tax paying home owner for instance we have for vying for property by the new Middle School, this came back to the city because the county did not sell the land, about $400,000 was owed, if the city gives it to one of these developers you the taxpayer just bought it for that business, the tax is still owed, a debt for those services was signed by the city, no fear, it is only worth about 200 homes.

What’s on your mind? KFYR AM radio program one of the Mandan School Board speakers states:

“The only way we can lower property taxes in Mandan;is to GROW Mandan.”

The game of "ketchup" is ongoing and the hot dog is never ending.

More Information

For 2009 all total the city of Mandan gave away $600,194.79 of your tax dollars, this is almost 9% of our current budget (little over $7million for 2011)plus this was not just the city's share this was the schools deprived of about $18,000 and the county and the park, now you the homeowner has to carry them on your paycheck, because the current law allows it.

300 homes will be needed to be built every year for double the exemption time to replace the lost revenue or your home’s value you will be needed to be raised to make up this lost revenue. Oh add in another 200 if the city gives away the land by the Mandan Middle School. They would like you to believe it costs nothing to give tax exemptions, oh but it does, the land was assessed and if it does generate the tax previously owed, the debt the city incurred has to be passed onto someone and the commercial properties don’t want the cost, let’s just pass it off on the unsuspecting home owners, they may call and complain but that is the price of “growth”. While the pennies in YOUR pocket disappear; look at what you have built, a never ending hot dog. Maybe I should say, “Hot diggity Dog!”

300 homes per year for 8 years to make up for what was given away in 2009, How many homes were built in Mandan in 2009: 35 homes a total of 84 properties and the value was not quite $15 million.The value of the tax exemption given was a little over $24 million a deficit in production of $9 million dollars.

Welcome to my website

The opinions expressed are mine, Susan Beehler and are not the opinions of any organizations, government, companies I may associate with. This website was orginally started to provide information on local government issues and than as a landing page to promote and spread the news of different community events, markets and whatever else I think might be of interest to others.

Focus once again are NOW on taxpayer issues. 2012

Copyright 2007 Suzybbuzz All rights reserved. All opinions are the exclusively expressed opinions of Suzybbuzz unless otherwise noted and are not affliated with any political party or government entity. All "See It" documents have been obtained from government entities through excerising the right to know by the state of North Dakota's "Sunshine Laws".

Mandan, ND 58554

ph: 701 220-2297

suzybbuz